The Blind Spot in Your Climate Strategy: Why TCFD Needs TNFD

Most corporate risk models suffer from a flaw. They treat climate change and nature loss as separate challenges. They are not.

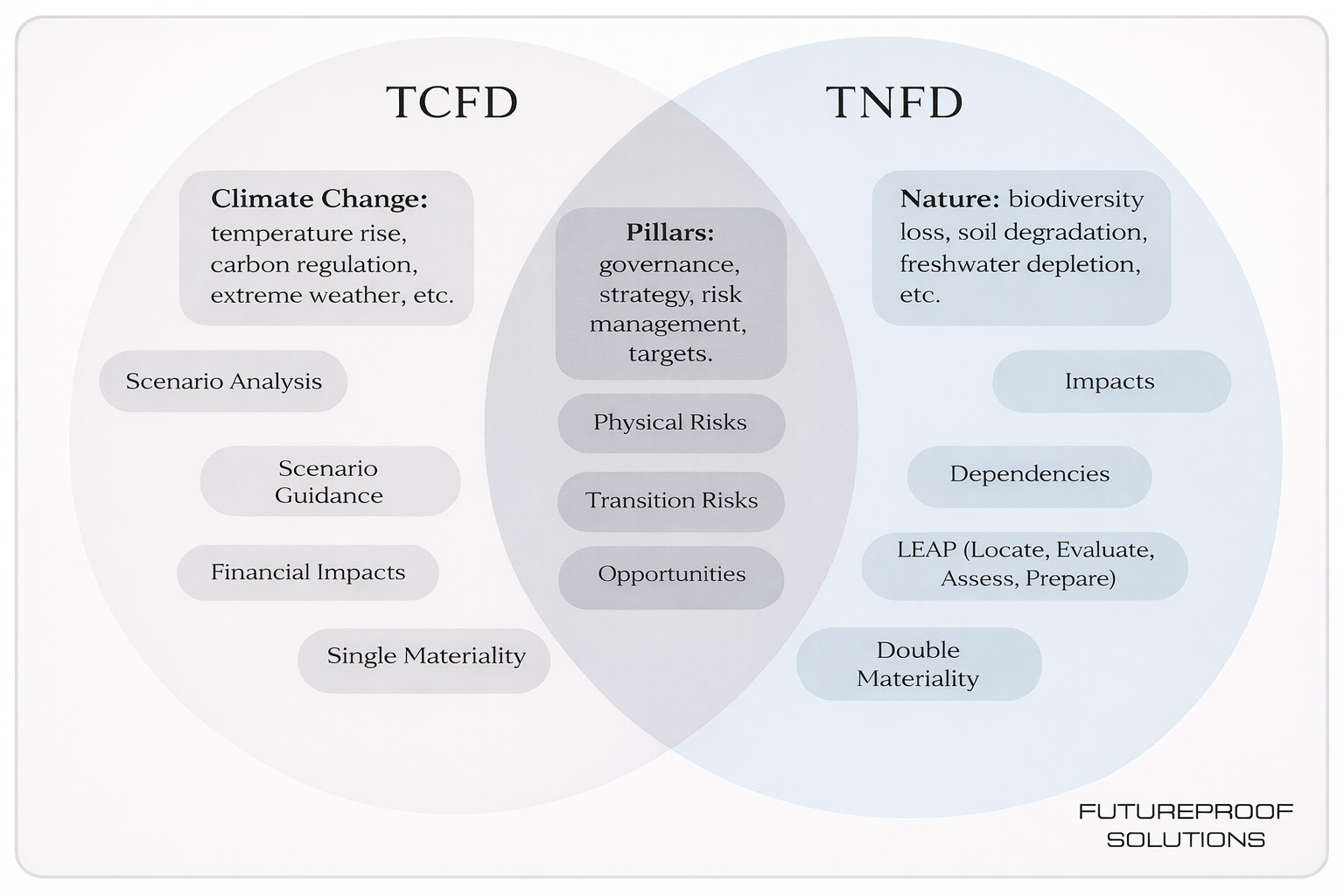

Nature degradation acts as a force multiplier for climate risk, stripping away the ecosystem "buffers" that protect operations from extreme weather. By integrating the Taskforce on Nature-related Financial Disclosures (TNFD) methodology into existing climate frameworks (TCFD), companies can uncover hidden compounding risks and move from compliance-based reporting to genuine financial resilience.

The Compounding Risk of Working in Silos

Over the last decade, companies have successfully embedded climate risk into their strategic architecture. Through TCFD frameworks, they have run scenarios and modeled carbon transition pathways. Yet, nature risk remains siloed, often managed by sustainability teams and disconnected from the capital allocation models that drive the business.

This separation creates a dangerous blind spot. Because in ecosystem, climate and nature do not operate in parallel, they interact. Extreme weather accelerates ecosystem degradation, and degraded ecosystems, such as deforested watersheds or eroded soils, lose their capacity to buffer physical risks.

When these risks are assessed separately, companies systematically underestimate exposure. A climate-only model might predict drought, but it misses the fact that local deforestation has already destroyed the watershed’s ability to retain moisture, and this might turn a moderate drought prediction into a catastrophic supply failure.

So there is a business case for integration: If TCFD provides the house, TNFD provides the foundation:

TCFD established the financial disclosure architecture: Governance, Strategy, Risk Management, and Metrics. It taught markets to think in forward-looking scenarios.

TNFD extends this logic to the natural assets that underpin business continuity. Its LEAP methodology (Locate, Evaluate, Assess, Prepare) brings a diagnostic tool to map the dependencies that TCFD often misses.

Case Study: The "Soy Trap"

The danger of parallel assessment tracks is most visible in commodity-dependent sectors. Consider a food and beverage company capitalizing on the rise of plant-based drinks by sourcing soy from South America:

Climate Models predict moderate drought risk.

Compliance team flags new EU deforestation regulations (EUDR).

And Biodiversity/Sustainability team notes high local deforestation rates.

Separately, these risks look manageable. Connected, they reveal a compounding crisis in the ecosystems where the company operates. The deforestation (nature risk) erodes the land’s ability to retain water and regulate the local microclimate. This amplifies the financial impact of projected climate-driven droughts (physical risk) and exposes the company to market-access risks from emerging deforestation-free laws (transition risk).

The result is a threat to supply continuity and price stability far greater than any single model predicted. The company needs more than reactive risk management; it requires a proactive strategy for resilient sourcing and smarter capital allocation.

The Regulatory Push

Crucially, value chain analysis is now a regulatory mandate. CSRD and ISSB both require companies to examine upstream and downstream dependencies. For sectors heavily reliant on commodities like soy, cocoa, or cotton, integrating ingredient risk screening is critical and requires a dual analytical lens:

· Risks to the business: How ecosystem collapse (e.g., soil erosion) affects yields and costs (like drought affecting soil fertility and crop yields).

· Risks from the business: How sourcing practices drive biodiversity loss, triggering regulatory and reputational blowback.

Tools such as TNFD’s LEAP approach help structure this assessment, capturing both dependencies on and impacts to nature, and translating them into financial terms.

Now, How To Proceed?

Don't reinvent, extend. You do not need a new operating model, you need to extend the TCFD framework you have already built.

1. Expand the Four Pillars

Governance: Move nature oversight out of the sustainability committee and into the board’s audit and risk committees alongside climate.

Strategy: Update climate scenarios to include nature-loss multipliers. Does ecosystem decline change the probability of your physical risk scenarios?

Risk Management: Create a unified taxonomy. Stop managing "carbon" and "water" as competing priorities, manage "operational resilience."

Metrics: Pivot from abstract indicators (e.g., "hectares restored") to financial metrics: input volatility, insurance premiums, and CapEx requirements.

2. Deploy LEAP as a Plugin

Use the TNFD’s LEAP approach to feed better data into your existing climate models:

Locate the assets interfacing with stressed ecosystems.

Evaluate the health of those ecosystems.

Assess how their degradation amplifies financial risk.

Prepare integrated disclosures.

Organizations have spent years building TCFD muscle. TNFD is not a new exercise, it is the missing analytical layer that makes that muscle functional.

Full integration requires linking nature dependencies (healthy soil, water availability) with climate hazards (drought, floods) to quantify how they compound. This is the work that moves companies from backward-looking compliance to forward-looking resilience, proving to investors that they understand the complex reality of a planet in flux.

At Futureproof Solutions, we help companies move from insight to action through integrated climate and nature risk assessments tailored to their value chains.

Let us know how we can help.