Beyond Net Zero: Why Adaptation is the New Alpha in Real Estate

Over the last decade of risk analysis, the real estate sector has mastered the art of mitigation. Carbon tons are counted, LED lights retrofitted, and Net Zero targets pursued with rigor. The industry is largely winning the battle on "green" credentials.

Yet a critical gap persists. Adaptation remains dangerously underweighted. For portfolio managers, this represents a solvency problem more than an environmental one.

While the sector has focused on reducing emissions (mitigation), the impacts already locked in (adaptation) have been largely ignored. Recent IPCC assessments confirm this: adaptation lags behind, with only limited widespread implementation despite mature mitigation practices.

Put it in real estate language: A Net Zero building can still flood. A BREEAM "Outstanding" office can still become uninhabitable during a heatwave, like those projected by Copernicus for EU summers in 2026. Climate change delivers both long-term consequences and short-term impacts.

So the conversation needs to shift from climate risk as a future compliance headache to a present financial reality. The "cost of inaction" is hitting P&Ls right now. Munich Re reports show 2025 insured losses from natural disasters reaching $108 billion, driven by floods, wildfires, and storms: fueling skyrocketing cooling costs, uninsurable assets, and "brown discounts" where buyers chip away at valuations because they see the risks that haven't been mitigated.

Neglecting adaptation doesn't just mean physical damage, it also means operational bleed. Recent EDHEC research suggests some infrastructure investors could lose half their portfolio value to physical risks by 2050 in runaway climate change scenarios. That's not a "dip", that's a wipeout.

Exposure is Geography, Vulnerability is Engineering

One critical distinction separates winners from losers: the difference between exposure and vulnerability.

Exposure is bad luck: A building sits in a flood zone. The location can't change.

Vulnerability is bad management: That same building has electrical switchgear in the basement. Elevating such critical systems can reduce flood vulnerability by up to 70%, per IPCC guidelines on resilient infrastructure.

Exposure gets priced into insurance premiums and valuations regardless of what's done about it. Vulnerability, on the other hand, is entirely controllable, and that's where the real alpha lives.

Think of exposure as the hand dealt by geography and climate science. Vulnerability is how that hand gets played.

A coastal asset will always face sea-level rise exposure, but whether it has flood barriers, backup power systems, and climate-controlled server rooms determines whether it becomes a stranded asset or a premium property. The market is starting to recognize this: assets with high exposure but low vulnerability are dramatically outperforming those with the inverse profile.

Here is the thing: two identical assets on the same location face the same exposure. But if one has permeable paving and elevated critical systems while the other doesn't, their financial futures are radically different.

The tools are out there—modern climate risk tools leverage CMIP6, which provides the latest and most advanced climate projections, offering valuable insights into how specific assets will react when the water rises or the heat spikes—they are waiting to be used, and the results are waiting to be exploited.

Regulation, Black Box Scores, and Opportunities

There's often groaning at new regulations, but frameworks like the EU Taxonomy and Sustainable Finance Disclosure Regulation (SFDR), interlinked with CSRD reporting, are actually providing a lifeline. They force the industry to tackle both physical adaptation and transition risks, like retrofit mandates for decarbonization.

The EU Taxonomy explicitly treats "climate change adaptation" as a fundamental objective alongside mitigation. It's asking a simple commercial question: Can this asset survive the next 30 years, through both floods and policy shifts? If the answer is "I am not sure," the asset is increasingly uninvestable.

Fo sure, there's comfort in relying on what the Observatoire de l'Immobilier Durable calls "black box" risk assessments, opaque scores from data providers that flag risk but don't explain why. But the problem is, a score on its own without measures is useless for building resilience. Asset managers need to understand the "why" more than anyone else, so they can walk the last mile to build resilience around these vulnerabilities.

Think renovating a house: strategic improvements increase market value. Same principle. Climate-adapted properties attract real premiums: EU analyses show enhanced asset values (up to 28% in commercial real estate) and lower lending spreads (5%+ for green buildings), driving superior long-term cap rates and returns versus vulnerable assets.

So, don't settle for a risk score. Build a resilience plan. Nature-based solutions like green roofs are low-capex wins: 2°C urban heat reduction, 30-50% cooling load cuts via evapotranspiration and insulation. They are the solutions of today and will be standing in the future.

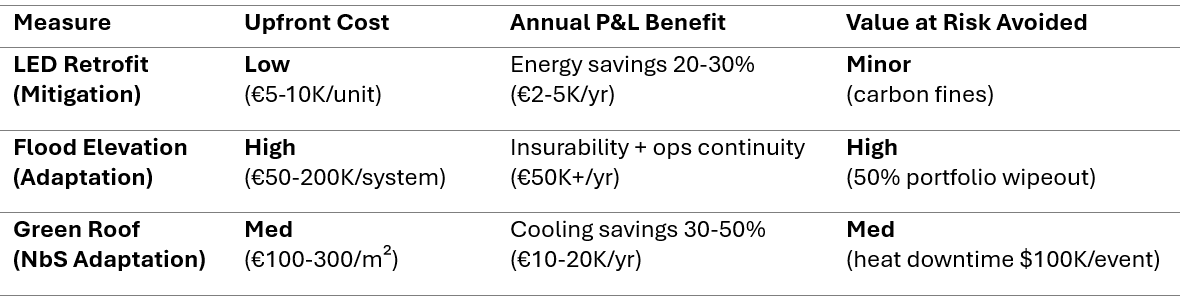

The economics are straightforward:

So What's the Action Plan?

The good news is building resilience doesn't require reinventing the entire foundation. Start with three fundamental steps can already provide immediate clarity on where portfolios actually stand.

First, map the exposure. Use CMIP6 hazard maps to rank assets by flood/heat risk. This first step will allow you to know which buildings are sitting in the crosshairs and which have breathing room.

Second, assess the vulnerability. Conduct on-site audits for critical systems. Where's the switchgear? How's the drainage? This is where nature-based solutions like green roofs move from nice-to-have to strategic priority.

Third, model the finances. Stress-test P&L scenarios against $108B-scale events. Quantify how those 28% EU green premium uplifts translate to real returns. Make adaptation speak CFO language.

In the next decade, the most valuable buildings will not just save energy. They will be standing, operational, insurable, and financeable. At Futureproof Solutions, we partner with CLIMATIG to translate climate risk into actionable financial intelligence, so you can protect solvency, strengthen value, and build resilience with measurable impact.

Let us know how we can help you.